The financial industry is currently facing intense competition and increasing customer expectations. To thrive in this landscape, financial service providers must not only attract visitors to their websites but also convert them into loyal customers.

Conversion Rate Optimization (CRO) is a strategic approach that focuses on improving the percentage of website visitors who take desired actions, such as making a purchase, submitting a form, or signing up for a service. For financial services, optimizing conversions is vital for driving growth, increasing customer acquisition, and maximizing revenue.

Whether you are a bank, insurance company, investment firm, or any other financial service provider, we’ll give you strategies to enhance user experience, increase customer engagement, and ultimately drive business growth.

Table of Contents

Financial Services Website Conversion Benchmarks

Conversion rates can vary significantly depending on the specific sector within the financial services industry, and based on which goals they’re aiming for (sign-up, new accounts, downloads, investments…), which result in a range of conversion rates. Having noted that the range of median conversion rates for the industry are between 3.4% and 5%.

While it’s important to remember that every business is unique, having industry benchmarks can provide a useful reference point for evaluating your website’s performance.

Here are a few examples of conversion rate benchmarks for different financial service sectors:

- Banking: The average conversion rate for banking websites typically ranges between 2% to 5%. However, this can vary based on the complexity of services, such as account openings, loan applications, or credit card sign-ups.

- Insurance: Insurance websites often have conversion rates from 1% to 3%. The conversion actions may include requesting a quote, filling out an application form, or purchasing a policy.

- Investment and Wealth Management: Conversion rates for investment and wealth management websites can vary widely, depending on the specific services offered and the complexity of the investment process. Rates between 1% to 3% are commonly observed, considering actions like account registrations, consultation requests, or fund subscriptions.

It’s important to note that these benchmarks serve as guidelines. Factors such as target audience, website design, marketing efforts, and user experience can all have a heavy impact on your conversion rate.

Get your website’s conversion score in minutes

- Instant CRO performance score

- Friction and intent issues detected automatically

- Free report with clear next steps

Analyzing and Comparing Conversion Rates Across Different Financial Service Sectors

To effectively evaluate your financial services website’s conversion rate, it’s valuable to compare it with the rates achieved by other players in the industry. This analysis provides insights into industry trends, highlights potential areas for improvement, and helps you set realistic goals for optimizing your website’s conversions.

Here’s how you can conduct a meaningful comparison:

- Research: Start by researching conversion rate data and industry benchmarks specific to your financial service sector. Industry reports, case studies, and market research can provide valuable information and insights.

- Identify Comparable Metrics: Identify the key metrics used to calculate conversion rates within your sector. This may include actions like form submissions, account registrations, purchases, or lead generation.

- Competitor Analysis: Analyze the conversion rates of your direct competitors or industry leaders. This helps you gauge how well your website is performing in comparison and identify potential gaps or areas where you can excel.

- Internal Analysis: Compare your current conversion rates with your historical data. Look for patterns, trends, and changes over time to identify areas of improvement or success.

- Consider Factors and Context: While comparing conversion rates, consider various factors such as target audience, marketing strategies, user experience, and website functionality. This contextual analysis will provide a deeper understanding of the reasons behind the observed conversion rates.

Identifying Conversion Optimization Opportunities in Financial Services Websites

1. Understanding Your Target Audience

Segment and define your target audience personas:

- Analyze your target audience demographics, such as age, income, occupation, and financial goals.

- Create detailed personas representing different segments within your audience to tailor your messaging and offerings effectively.

Then, identify your audience’s main pain points and motivations for conversion:

- Conduct market research, surveys, and customer interviews to understand the challenges, needs, and motivations of your audience.

- Identify pain points related to financial services specifically and determine how your offerings can address them.

2. Streamline the User Journey

First, map your typical user journey to get a full understanding:

- Identify the different stages users go through, from initial research to conversion and post-conversion engagement.

- Understand the touchpoints, channels, and interactions users have during each stage.

With this, you will be able to identify potential drop-off points and optimize your marketing touchpoints:

- Analyze website analytics, user behavior data, and conversion funnels to identify areas where users drop off or face difficulties.

- Optimize those touchpoints by simplifying forms, reducing steps, providing clear information, and addressing user concerns.

As this is one of the most strategic and complex steps in your conversion rate optimization, we have put together a bundle of downloadable resources to help you optimize your user journey with AI.

3. Build Trust and Credibility

Establishing credibility is especially vital in the financial industry. To strengthen it, you should:

- Display trust signals such as security badges, affiliations with reputable organizations, and certifications prominently on your website.

- Highlight awards, accolades, and recognition to establish credibility and demonstrate expertise.

- Gather and showcase testimonials from satisfied customers, highlighting their positive experiences with your financial services.

- Implement robust security features, such as SSL certificates and encryption, to protect user data.

4. Optimize Your Landing Pages

- Traditional landing pages are on the low. Learn how to create a personalized landing page with tailored messages that actually increase conversions.

- Landing pages must be clear and visually appealing, aligned with user expectations and goals.

- Use compelling headlines, persuasive copy, and attractive visuals to communicate the value proposition of your financial services.

- Use strong and actionable calls-to-actions (CTAs) buttons to guide users toward conversion, emphasizing urgency or exclusivity when appropriate.

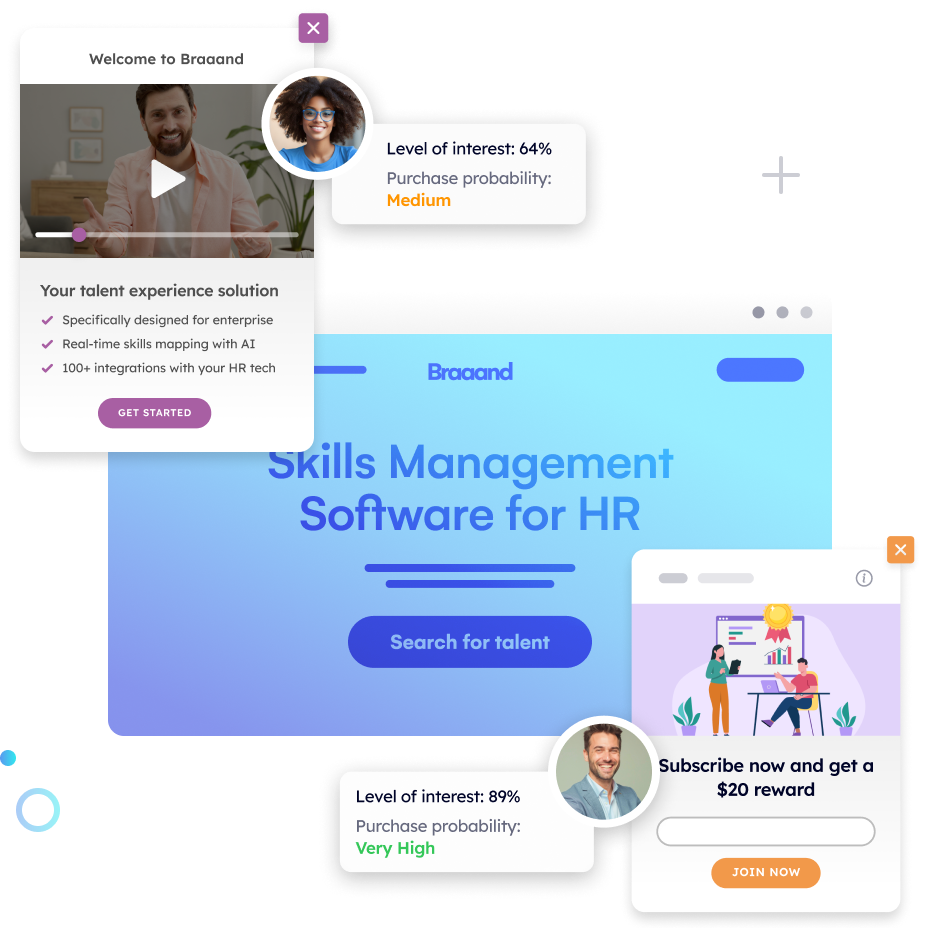

5. Personalize the User Experience Based on Real-Time Intent and Preferences

- Use machine learning and user profiling to offer tailored micro-experiences to your potential customers. User experiences based on user preferences and behaviors will enhance engagement and increase conversions. On average, this tactic helps business boost their conversion rate by 50%.

Increase +180% conversions from your website with AI

Get more conversions from your existing traffic by delivering personalized experiences in real time.

- Adapt your website to each visitor’s intent automatically

- Increase conversions without redesigns or dev work

- Turn anonymous traffic into revenue at scale

- Customize recommendations, product suggestions, and relevant content based on individual user profiles.

6. Ensure Your Website is Optimized for Mobile Devices

Users increasingly rely on their smartphones and tablets to perform various financial activities. From checking account balances to making transactions, users expect seamless experiences on their mobile devices, meaning this step is of the utmost importance.

- Optimize your website for mobile devices with responsive design, fast loading times, and user-friendly navigation.

- Ensure your website is mobile-responsive, providing an optimal experience across various screen sizes and orientations.

- Simplify forms, streamline navigation, and prioritize key information for mobile users to enhance conversions.

Mobile optimization is also crucial for search engine optimization (SEO). Search engines prioritize mobile-friendly websites in their rankings, making it essential for financial services to optimize their sites for mobile devices to improve visibility and attract organic traffic.

Testing and Iteration, the Widely Forgotten Steps in Financial Services Marketing

When it comes to marketing in the financial services industry, testing and iteration are often overlooked or underestimated. In a fast-paced industry like financial services, marketers may feel pressured to prioritize other tasks, such as campaign execution or meeting immediate targets, leaving little time for testing. Beyond this, many financial organizations continue to use traditional marketing approaches which are resistant to change.

However, these steps are crucial for driving continuous improvement and achieving optimal results.

- Conduct A/B tests to compare different variations of web elements, such as headlines, CTAs, layouts, or color schemes.

- Measure and analyze the performance of each variation to identify the most effective design or messaging.

- Monitor key metrics, such as conversion rates, click-through rates, and bounce rates, to track the impact of optimizations.

- Use data analysis to identify trends, patterns, and areas for improvement, and make iterative changes based on data-driven insights.

Conclusion

Conversion rate optimization is critical to achieving success in the financial services industry. To achieve remarkable conversion rates, financial service providers should prioritize user journeys, establish trust and credibility, optimize landing pages, personalize user experiences, and conduct A/B tests.

Mobile optimization has emerged as a crucial factor, given the increasing use of mobile devices in accessing financial services. By ensuring websites are mobile-friendly, accessible, and convenient, businesses can gain a competitive edge, improve user experiences, and drive higher conversions.

It’s important not to overlook the often-forgotten steps of testing and iteration in financial services marketing. By embracing data-driven decision-making, continuous improvement, and adaptability to market dynamics, organizations can remain competitive and meet evolving customer expectations.