Introduction

In this episode of Pathmonk Presents, host Ernesto interviews Maja Hamberg, head of marketing at SixFold, the first genAI solution for insurance underwriters.

Maja discusses how SixFold is revolutionizing the insurance industry by bringing efficiency to the underwriting process through AI-powered solutions. She shares insights on their B2B marketing strategies, including the importance of website optimization, content creation, and leveraging conferences for lead generation.

Maja also offers valuable advice on staying up-to-date with marketing trends and focusing on key tasks for maximum impact in B2B marketing.

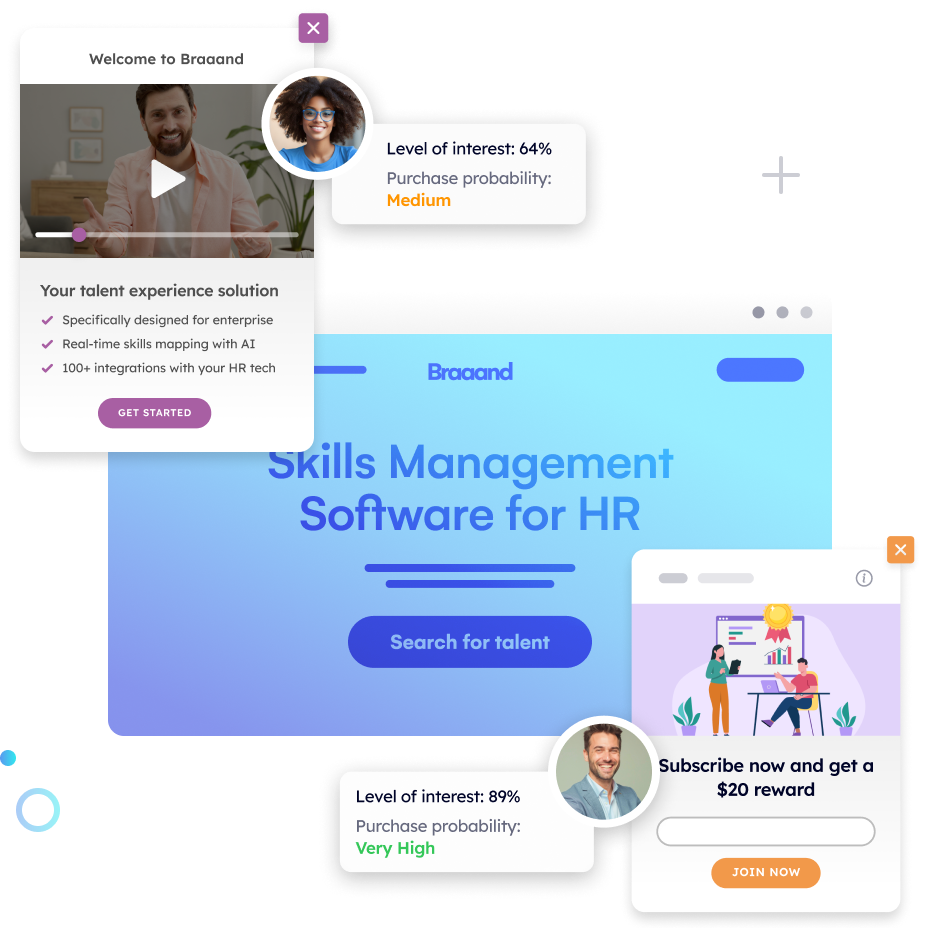

Increase +180% conversions from your website with AI

Get more conversions from your existing traffic by delivering personalized experiences in real time.

- Adapt your website to each visitor’s intent automatically

- Increase conversions without redesigns or dev work

- Turn anonymous traffic into revenue at scale

Ernesto Quezada: Pathmonk is the intelligent tool for website lead generation. With increasing online competition, over 98% of website visitors don’t convert. The ability to successfully show your value proposition and support visitors in their buying journey separates you from the competition online. Pathmonk qualifies and converts leads on your website by figuring out where they are in the buying journey and influencing them in key decision moments. With relevant micro experiences like case studies, intro videos, and much more, stay relevant to your visitors and increase conversions by 50%. Add Pathmonk to your website in seconds. Let the AI do all the work and get access to 50% more qualified leads while you keep doing marketing and sales as usual. Check us on pathmonk.com. Welcome to today’s episode. Let’s talk about today’s guest. We have Maja from SixFold, head of marketing with them. How are you doing today, Maja?

Maja Hamberg: I am good. Happy to be here. How are you doing?

Ernesto: I’m doing great. Great. Thank you so much for asking. And, well, I’m sure, Maja, our listeners are tuning in, wondering what SixFold is all about. So, in your own words, tell us a little bit more.

Maja: Yeah, sure. So SixFold is the first GenAI for insurance underwriters. Basically, all we do every day is try to bring efficiency to the underwriting process. I don’t know how much you know about underwriting, but it’s a pretty complex process and involves a lot of manual work at the moment. All we want to do is take away those heavy-duty tasks, which can also be considered pretty boring for underwriters, so that they can focus on making smarter risk decisions.

Ernesto: Definitely important. Okay. And so, that way, our listeners can get a good understanding of SixFold, what’s the key problem that you guys are solving for clients?

Maja: We’re basically bringing efficiency to a process that is currently very data-heavy. Imagine underwriters getting hundreds of pages of information about a business and having to define if it’s a good risk for them or not. That can take days or weeks, depending on the case. We want to take all the data, summarize it for the underwriters, and tell them, “Hey, this is a good risk for you, and these are some key areas to look at,” so they can define how much to charge for that risk.

Ernesto: Okay, very good. Great. And is there a certain vertical or an ideal ICP that SixFold focuses on?

Maja: Yeah, definitely. We primarily work with insurance carriers, MGAs, and reinsurance companies. Usually, the decision-makers for us are heads of innovation or chief underwriting officers. It’s interesting because it’s quite diverse depending on how big the companies are, but the decision typically falls within the innovation or underwriting teams.

Ernesto: Okay, great to hear that. So, how would someone usually find out about SixFold? Is there a top client acquisition channel for you guys?

Maja: Google is an obvious one. We recently launched a lot of new web pages, and they’ve started generating a lot of new leads for us. Google has become one of our top channels. Conferences are another important channel since we’re a B2B solution with a longer sales cycle. Meeting prospects in person at conferences has proven to be very valuable. Lastly, LinkedIn plays a significant role for us. Two of our founders have extensive industry experience, and growing their presence on LinkedIn has been important for showcasing their expertise.

Ernesto: Okay, great to hear that. And so, our listeners who are tuned in can visit you at SixFold AI. What role does the website play in client acquisition?

Maja: The website plays a huge role, obviously. It’s where people find us on Google, check our LinkedIn, and try to figure out if we’re the right AI solution for them. Building out our website has been crucial because we have a few different target audiences within insurance. We need to ensure the website speaks their language and addresses their needs.

Ernesto: Definitely important. On that note, Maja, are there any tools, tips, or methods you’d recommend for website lead generation?

Maja: Yes, absolutely. First, I’d say keep the messaging simple and straightforward. Don’t go overly technical—it just doesn’t resonate as well. Second, think about where you want users to go on your website. Instead of having too many CTAs like “Get in touch,” focus on guiding users to the key pages they need to see before they leave. Showcase those bullet points that matter most to them.

Ernesto: Great to hear that. Let’s switch gears and talk about you as a leader. What are some key tasks you focus on in your day-to-day work?

Maja: Right now, we’re heavily focused on content production. We launched a year ago and have been developing blog posts, case studies, and more. Content takes up about 60% of my day—collaborating on PR pitch lists, planning the next blog topics, and creating LinkedIn content. Apart from that, I spend time working with the product team on defining product messaging and planning product launches. Lastly, events and conferences are a big focus for us, which also involves planning dinners or happy hours around those events. Events always seem to take more time than expected!

Ernesto: Very good. How do you stay up to date with news in the marketing world, trends, and strategies? Is there a preferred channel you use?

Maja: Yes, there’s a lot to keep up with! I follow a few B2B newsletters, like Mutiny—it’s a B2B marketing community that I’m part of. I also spend time on LinkedIn, scrolling and clicking around to see what others are doing. I follow some VCs in the insurance world who consistently deliver great content. So, newsletters and LinkedIn are my go-to sources.

Ernesto: Great to hear that. Thank you so much for sharing. Let’s jump into our rapid-fire questions. Are you ready?

Maja: I’m ready. Go for it!

Ernesto: Perfect. First off, what’s the last book you read?

Maja: It’s not marketing-related, but I recently read Normal People by Sally Rooney. I’d highly recommend it—it’s a great book.

Ernesto: Great recommendation. Next, if there were no boundaries in technology, what’s the one thing you’d fix for your role as a marketer?

Maja: Definitely the CRM system—optimizing it as much as possible and automating everything. We use HubSpot, which is great, but it still takes a lot of work to fine-tune and ensure all the data is up to date. Automating that process would be amazing.

Ernesto: If there’s one repetitive task you could automate, what would it be?

Maja: Campaign reporting and analytics. Even with tools out there, it still requires manual work to collect data from different platforms. Automating that would save so much time.

Ernesto: Lastly, Maja, you have the experience, but what’s one piece of advice you’d give yourself if you were restarting your marketing career?

Maja: Don’t try to do everything. Focus on two things and do them extremely well. In the beginning, I tried to do everything—every new tool, every channel. But what works best is focusing on a couple of key areas and excelling at those.

Ernesto: Love that advice. Thank you so much, Maja. Before we wrap up, what’s the one thing people should remember about SixFold?

Maja: They should remember that we’re doing something completely new in the insurance underwriting industry. We’re bringing purpose-built AI to underwriting, with ten customized models excelling at underwriting tasks. It’s something I’m very proud of.

Ernesto: Great notes to end on. Thank you so much for being with us today, Maja. To our listeners, check them out at SixFold AI. Looking forward to the next episode here at Pathmonk Presents. Thanks a lot, Maja.

Maja: Thank you so much for having me!