Introduction

In this episode, we welcome Jonny Price, VP of Fundraising at Wefunder, a platform democratizing startup investing.

Jonny explains how Wefunder enables entrepreneurs to raise capital from their customers and community, breaking down traditional barriers in startup funding. He discusses the platform’s two-sided marketplace model, client acquisition strategies, and the impact of community rounds on customer loyalty. Jonny also shares valuable insights on leadership, emphasizing the importance of individual contribution and staying close to customers.

This episode offers a comprehensive look at innovative fundraising methods and the evolving landscape of startup investing.

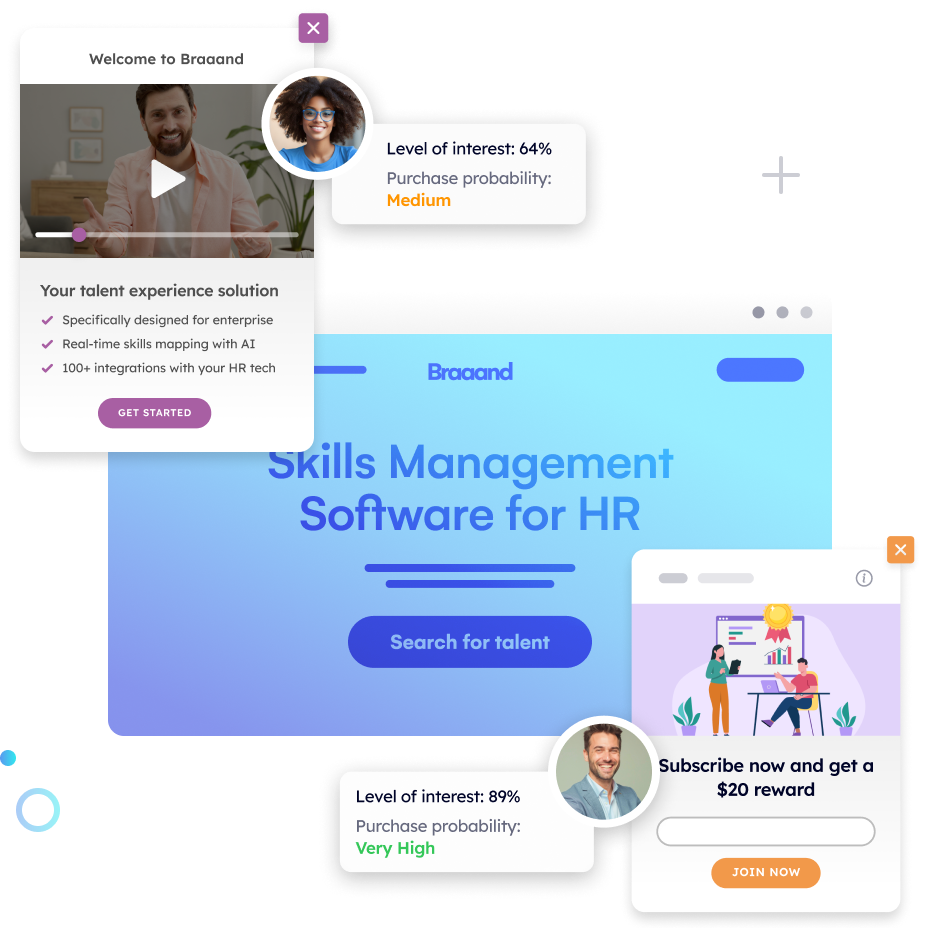

Increase +180% conversions from your website with AI

Get more conversions from your existing traffic by delivering personalized experiences in real time.

- Adapt your website to each visitor’s intent automatically

- Increase conversions without redesigns or dev work

- Turn anonymous traffic into revenue at scale

Ernesto Quezada: Pathmonk is the intelligent tool for website lead generation. With increasing online competition, over 98% of website visitors don’t convert. The ability to successfully show your value proposition and support visitors in their buying journey separates you from the competition online. Pathmonk qualifies and converts leads on your website by figuring out where they are in the buying journey and influencing them in key decision moments. With relevant micro-experiences like case studies, intro videos, and much more, stay relevant to your visitors and increase conversions by 50%. Add Pathmonk to your website in seconds. Let the AI do all the work and get access to 50% more qualified leads while you keep doing marketing and sales as usual. Check us out on pathmonk.com. Welcome to today’s episode. Let’s talk about today’s guest. We have Jonny, VP of fundraising at Wefunder. How are you doing today, Jonny?

Jonny Price: I’m doing great, man. Thanks for having me. Good to be here.

Ernesto: It’s great to have you on! So, Jonny, I’m sure our listeners are tuning in, wondering what Wefunder is all about. Let’s kick it off with that. In your own words, can you tell us a little bit more?

Jonny: Yeah, so Wefunder is a tool that helps startup founders raise capital from their customers and community. Normally, when entrepreneurs are raising capital, they’re reaching out to venture capital firms or angel investors who are usually millionaires. What Wefunder is all about is democratizing startup investing and letting everyone invest in the startups they love, not just rich people. These can be tech startups like Substack, Mercury Bank, or Relay, or main street businesses like breweries, restaurants, or coffee shops.

Ernesto: Okay, interesting. So, for our listeners to get a good understanding of Wefunder, what would you say is the key problem you guys like to solve for clients?

Jonny: Yeah, we’re a two-sided marketplace, right? So we have entrepreneurs or founders raising capital, and then we have investors who are investing in startup companies on the platform. On the founder side, I’d say we’re addressing two main problems. One, we make it easier to raise capital. Now founders can turn their customers into investors, publicly promote the offering, and get in front of 2 million Wefunder investors. This opens up a new pool of capital to raise from. The second is that we help consumer-facing businesses strengthen their relationships with their customers. When you turn your customers into owners, they’re likely to spend more, stay loyal, and tell others about you. So, we’re making it easier to raise money and helping founders build stronger relationships with their customers.

For the investor side, we’re enabling everyday people, not just millionaires, to invest in early-stage companies. Normally, you’d need to be an accredited investor to invest in companies before they go public. Wefunder lets ordinary Americans get in on early investment opportunities, and hopefully, they can get in on the seed round of the next big startup.

Ernesto: Very cool! So is there a certain vertical or an ideal ICP for you guys?

Jonny: We’re actually pretty eclectic. We fund a lot of tech startups, but we also fund main street businesses, like breweries and coffee shops, as well as soccer clubs, movies, CPG companies, and biotech. We have companies raising small friends-and-family rounds of $50,000–$100,000, and we also have larger companies, like Mercury Bank, that raised a $120 million series B with a $5 million community round on Wefunder, filled in just 24 hours. So, we’re really open to all sorts of sectors and stages within the U.S.

Ernesto: Great to hear! So how does someone usually find out about Wefunder? Is there a top client acquisition channel for you?

Jonny: Yeah, we’ve experimented with a lot of channels, so I wouldn’t say we have a clear winner. We get a lot of inbound leads, especially from people searching for “community round,” where we pop up. I lead our business development team, and we do a lot of direct outreach via email, LinkedIn, Twitter, as well as establishing partnerships with VCs, fractional CFOs, lawyers, and accelerators who refer clients to us. On the investor side, our platform benefits from founders who drive a lot of the investor acquisition. For example, when Substack launched on Wefunder, they raised $5 million in a day from their customers. Those investors then become Wefunder users, so that drives our growth on the investor side.

Ernesto: Makes sense. For listeners who want to check you out, they can visit wefunder.com. So, what role does the website play in client acquisition?

Jonny: Yeah, for founders, they can go to wefunder.com/raise to learn about the process, read FAQs, and start an application. They don’t even have to talk to someone at Wefunder to get started, though our team will usually jump on a call with them to help with any questions. For investors, most traffic comes from founders promoting their own campaigns. They might email their customers or post on social media, directing people to their Wefunder page, where visitors can watch the pitch, check out the business, and invest with as little as $100.

Ernesto: Got it. And is there any tool or strategy you recommend for website lead generation?

Jonny: On the founder side, it’s less about digital acquisition and more about sales or business development. We’ve tested Facebook and LinkedIn ads in the past, but the economics didn’t really work for us. So we focus more on direct outreach and relationship-building with potential referral partners.

Ernesto: Okay, perfect. Let’s switch gears a bit and talk about you as a leader. As the VP of fundraising, what are some key tasks you like to focus on in your day-to-day work?

Jonny: I do a lot of individual contribution, actually. I think there’s a stereotype that senior leaders should step back from hands-on work, but I enjoy it and find it energizing. I spend a lot of time on the phone with startup founders, building relationships with referral partners, and helping founders with their fundraising strategies. Staying close to the customer and hustling hard is where I think I add the most value.

Ernesto: Love that approach. So how do you stay updated on news and trends in the marketing world?

Jonny: I’m often on LinkedIn and Twitter, reading what catches my eye. I also listen to podcasts like Harry Stebbings’ and Logan Bartlett’s for industry insights.

Ernesto: Great choices! Let’s jump into our next section: rapid-fire questions. Are you ready?

Jonny: Yep, let’s go!

Ernesto: First off, what’s the last book you read?

Jonny: Amp It Up by Frank Slootman.

Ernesto: If there were no boundaries in technology, what’s one thing you’d want fixed for your role?

Jonny: Access to everyone’s email, so I can reach out directly.

Ernesto: Good one! And if you could automate one repetitive task, what would it be?

Jonny: Sending cold emails.

Ernesto: Definitely makes sense. And lastly, what’s one piece of advice you’d give yourself if you were to restart your journey as a marketer?

Jonny: Focus on quality versus quantity, and build key relationships rather than trying to do too much at once.

Ernesto: Great advice, Jonny. Well, we’re coming to the end of our show. Before we wrap up, if someone forgets everything about today, what’s the one thing they should remember about Wefunder?

Jonny: If you’re a founder looking to raise capital and build stronger customer relationships, Wefunder could be the right fit. And if you’re interested in startups, check out Wefunder as a way to start angel investing with as little as $100.

Ernesto: Awesome! You guys heard it—check them out at wefunder.com. Thanks so much for being with us, Jonny, and thank you to our listeners. Looking forward to our next episode at Pathmonk Presents. Thanks, Jonny.

Jonny: Thanks, man. See you soon.