Introduction

In this episode, we welcome Quinn Palmer, Growth Marketer at interVal, a company that revolutionizes financial data analysis for accounting firms, financial institutions, and wealth management firms.

Quinn shares insights into interVal’s innovative approach to uncovering valuable opportunities for small to medium enterprises using AI and automated data discovery. She discusses their marketing strategies, including the importance of website optimization, effective lead generation techniques, and the power of community in B2B marketing.

Quinn also offers valuable advice on staying updated with industry trends and emphasizes the significance of building genuine connections in the business world.

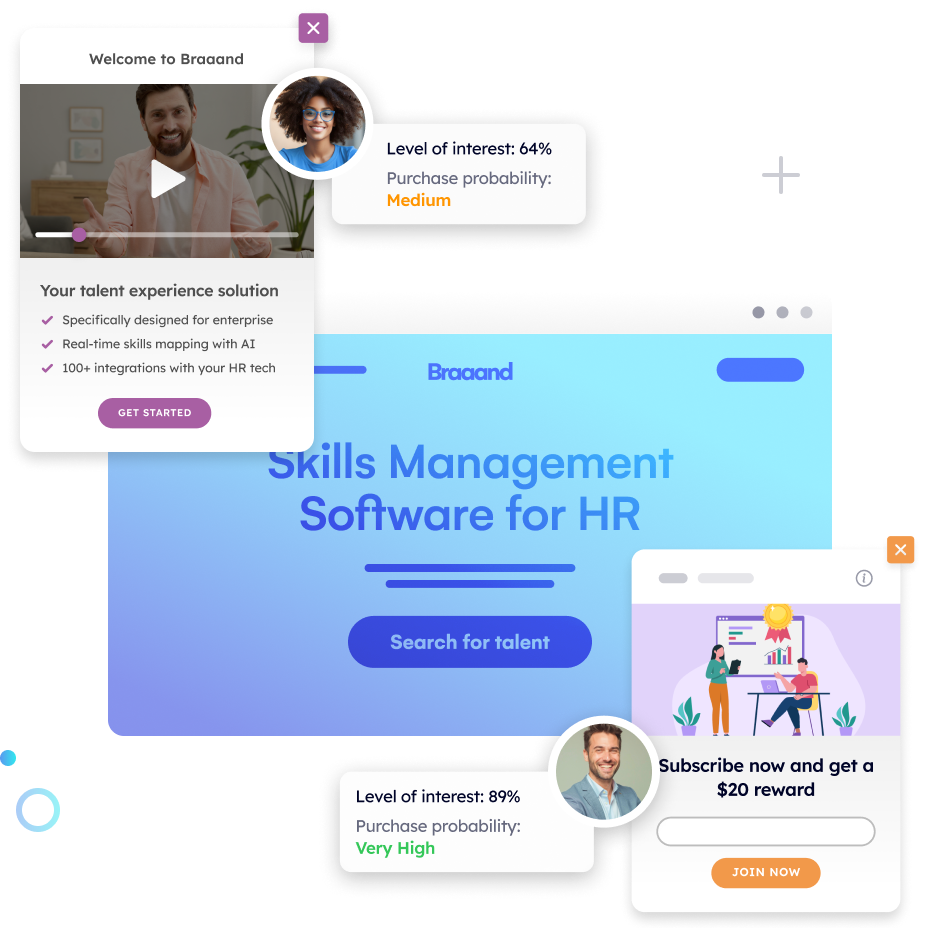

Increase +180% conversions from your website with AI

Get more conversions from your existing traffic by delivering personalized experiences in real time.

- Adapt your website to each visitor’s intent automatically

- Increase conversions without redesigns or dev work

- Turn anonymous traffic into revenue at scale

Ernesto Quezada: Pathmonk is the intelligent tool for website lead generation. With increasing online competition, over 98% of website visitors don’t convert. The ability to successfully show your value proposition and support visitors in their buying journey separates you from the competition online. Pathmonk qualifies and converts leads on your website by figuring out where they are in the buying journey and influencing them in key moments with relevant micro-experiences like case studies, intro videos, and much more. Stay relevant to your visitors and increase conversions by 50%. Add Pathmonk to your website in seconds. Let the AI do all the work and get access to 50% more qualified leads while you keep doing marketing and sales as usual. Check us out on pathmonk.com. Welcome to today’s episode. Let’s talk about today’s guest. We have Quinn from interVal. How are you doing today, Quinn?

Quinn Palmer: I’m good, thanks. How are you?

Ernesto: I’m doing great. Thank you so much for asking. And, well, Quinn, I’m sure our listeners are tuning in, wondering what interVal is all about. In your own words, tell us a little bit more.

Quinn: Absolutely. interVal helps accounting firms, financial institutions, and wealth management firms across North America essentially grow revenue in less time. We use automated data discovery and AI so that advisors can upload accounting documents of small to medium enterprise clients, which then automatically uncovers valuable opportunities linked to things like excess working capital, serviceable debt, and valuation. So basically, a wealth or financial advisor or an accountant gets teed up with all of these opportunities and ways that they can help their small to medium business clients grow or optimize, therefore creating more revenue for themselves or the firms that they work in. And all they have to do is start having the conversation.

Ernesto: That’s good to see. So, I mean, to give our listeners an understanding of interVal, what would you say is the key problem that you solve for your clients?

Quinn: It depends on what industry or vertical we’re in. It’s the same product across the board, but depending on who we’re talking to, they all have big hurdles to get over in each one. Oftentimes it’s human capital. In the accounting industry specifically, the CPA (Chartered Professional Accountant) graduation rate is plummeting and continues to decline. So there’s a lot of work and not a lot of people. We solve for time and problem-solving. Starting those conversations with, “Here’s some information you didn’t have before.” It’s information that’s always been hidden in accounting data, but by surfacing it, you can action a lot more items and therefore basically sell more products or more hourly time through discovery using our technology.

Ernesto: And, well, I mean, you already mentioned a couple of verticals like financial accounting and consulting. Is there any other segment you go for outside of those?

Quinn: Not necessarily. We’re always open to new ideas, but our three primary verticals are accounting firms, wealth firms, and banks or financial institutions. We have some credit union clients as well. The platform stays the same throughout, but it solves for different big-ticket values. For example, in banks, it’s sifting through data to find loan opportunities; in wealth, we generate opportunities for increased assets under management. So while it’s the same information across the board, there are different highlights for each user.

Ernesto: Great, great to hear that. So, if I were a credit union, how would I usually find out about interVal? Is there a top client acquisition channel for you?

Quinn: Yeah, we’re pretty new to the marketing game as a startup, so it’s a broad question. It changes every day as we’re trying new things. My role is a growth marketer, and the world is my oyster. We’re reporting on our first instances of doing different growth marketing activities. Primarily, it’s handshaking, networking, and referrals. We have a fantastic sales team that nurtures contacts like no other. From the marketing perspective, we’re seeing leads from paid media and events. I was hired as the first person with any PR or media background, so we’re learning what brings us the best inbound leads. I find that referral-based methods, even if it’s paid media through trusted sources like industry newsletters, YouTubers, and podcasts, have been great acquisition channels for us.

Ernesto: Awesome to hear that. So our listeners can visit you at interval.ai. What role does the website play in client acquisition?

Quinn: It’s a big part of the customer journey. When I first started, our sales team struggled with people saying they didn’t understand what we do based on our website. It was a weakness. Given that we sell to multiple verticals, the navigation wasn’t resonating with visitors. So we switched up the navigation when our marketing team grew. Now, visitors can identify themselves as an accounting firm, a banker, or a wealth firm right away, and we start to speak their language. It’s changed the game for us.

Ernesto: Great to hear. Is there any tool or method you’d recommend to our listeners to boost website lead generation?

Quinn: Concise copy and clear calls to action were missing on our site, and we saw traffic pick up after fixing that. If your website doesn’t make sense in the first few seconds, the lead is gone. I focus on what’s above the fold — can someone learn enough in 30 seconds to either understand or be interested? If not, it’s not working.

Ernesto: Interesting insights. Now, let’s switch gears and talk about you as a leader, Quinn. What are some key tasks you focus on day to day?

Quinn: With only two people on our marketing team, I do everything. My focus has been on field marketing and bringing qualified leads to the sales team. We recently pivoted from outbound to majority inbound marketing. Paid media and events are my main focus, and we rely on sponsorships, ads, and thought leadership to gain credibility. Reporting is also critical to prove return on investment and avoid repeating mistakes.

Ernesto: How do you stay up to date with trends in marketing?

Quinn: LinkedIn is essential for B2B sales and marketing. I also follow people outside my industry for fresh ideas and belong to a community called Grow Class. It’s been a huge help in thinking outside the box and connecting with others in similar situations.

Ernesto: Some great advice. Let’s move to the rapid-fire round. Are you ready?

Quinn: Yeah, give it to me.

Ernesto: What’s the last book you read?

Quinn: The Story of Us by Catherine Hernandez. It’s from the perspective of a fetus, which sounds odd, but I’d recommend it.

Ernesto: If there were no tech boundaries, what’s one thing you’d fix as a marketer?

Quinn: I wish SEO could be fully automated. It’s a lot of work and requires extensive knowledge.

Ernesto: What repetitive task would you automate?

Quinn: Posting on social media. We’re halfway there with tools, but it’s still time-consuming.

Ernesto: Lastly, what’s one piece of advice you’d give yourself if you could restart your journey?

Quinn: Stay connected with people who want to learn with and from you. Don’t treat interactions as transactional; that’s where the real value lies.

Ernesto: Great advice. Lastly, what’s one thing listeners should remember about interVal?

Quinn: Our goal is growth for everyone. We help people win together, whether they’re enterprise or small businesses.

Ernesto: Thanks for joining us, Quinn, and to our listeners, check out interval.ai. Looking forward to our next episode on Pathmonk Presents.

Quinn: Thank you!