Introduction

In this episode of Pathmonk Presents, host Ernesto welcomes Brianna Valleskey, Head of Marketing at Inscribe.

Brianna shares insights into Inscribe’s AI-powered solutions for fraud detection and risk assessment in the financial services sector. She discusses how their technology analyzes application data, including documents and open banking information, to identify trustworthy and creditworthy customers.

Brianna also delves into Inscribe’s marketing strategies, emphasizing the importance of data-driven decision-making and the role of their website in client acquisition. The conversation covers emerging trends in fraud prevention, the impact of generative AI, and valuable tips for effective marketing leadership.

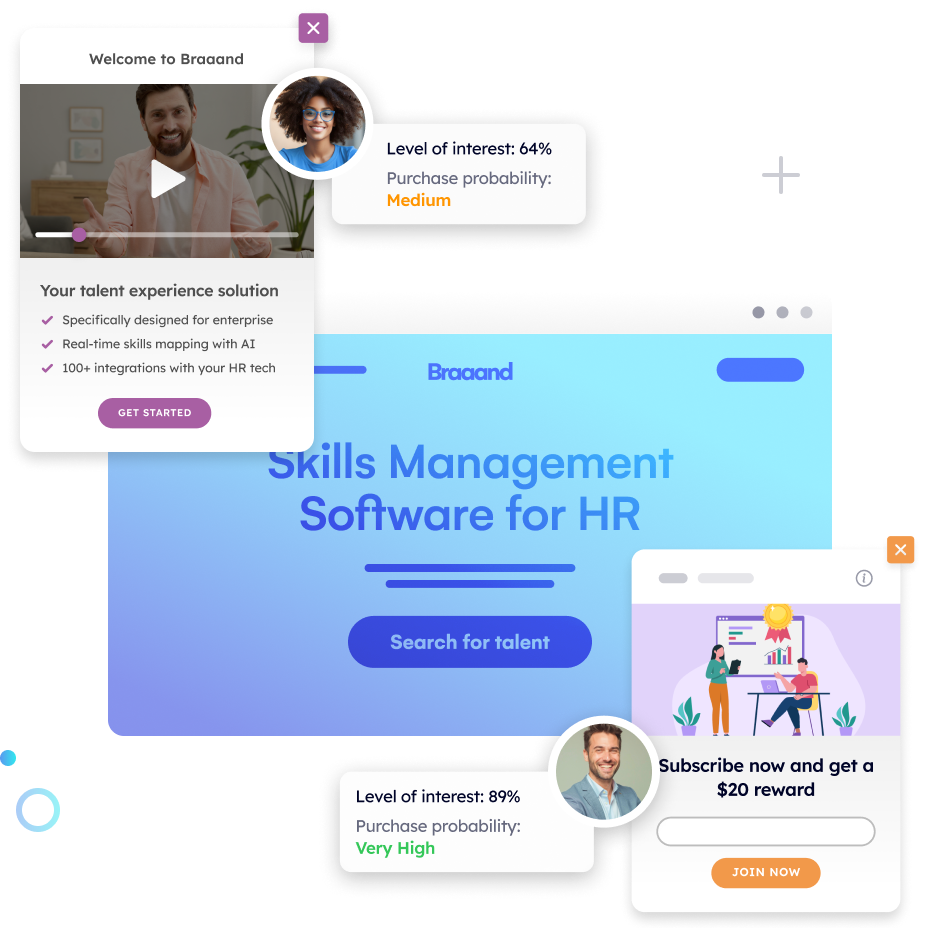

Increase +180% conversions from your website with AI

Get more conversions from your existing traffic by delivering personalized experiences in real time.

- Adapt your website to each visitor’s intent automatically

- Increase conversions without redesigns or dev work

- Turn anonymous traffic into revenue at scale

Ernesto Quezada: Pathmonk is the intelligent tool for website lead generation. With increasing online competition, over 98% of website visitors don’t convert. The ability to successfully show your value proposition and support visitors in their buying journey separates you from the competition online. Pathmonk qualifies and converts leads on your website by figuring out where they are in the buying journey and influencing them in key decision moments. With relevant micro experiences like case studies, intro videos, and much more, stay relevant to your visitors and increase conversions by 50%. Add Pathmonk to your website in seconds. Let the AI do all the work and get access to 50% more qualified leads while you keep doing marketing and sales as usual. Check us out at pathmonk.com. Welcome to today’s episode. Let’s talk about today’s guest. We have Brianna from Inscribe, head of marketing with them. How are you doing today, Bree?

Brianna Valleskey: I’m doing wonderful. Really happy to be here.

Ernesto: It’s great to have you on. Excited to learn a little bit more about what Inscribe is. And I’m sure our listeners are tuning in wondering what Inscribe is all about. So, let’s kick it off with that. Bree, in your own words, can you tell us a little bit more?

Brianna: I would love to. Inscribe is an AI company for fraud and risk teams. We help our customers identify trustworthy and creditworthy customers by analyzing their application data, mainly documents and open banking data. Basically, anytime you, as a consumer, apply for a bank account, credit card, or mortgage, you probably have to submit paperwork like bank statements and tax forms to show that you are who you say you are and qualify for this financial product. Inscribe checks those documents for signs of tampering or manipulation. If you’ve edited your bank balance using Photoshop or purchased a fake bank statement on the Internet and just put your name at the top, we use AI and machine learning to detect that in seconds, helping companies prevent fraud and losses. Then, if we determine that your application is trustworthy, we can also provide credit insights to assess your creditworthiness. A lot of institutions make lending decisions based only on credit scores, but that leaves millions of people without access to financial products. Sixty-two million Americans are thin file consumers, meaning they have less than five credit accounts, and another 26 million Americans are credit invisible—they don’t have any credit scores. Looking at alternative credit insights, typically like cash flow analysis, not only gives you a better overall picture of someone’s financial health but also creates more equitable access to financial products.

Ernesto: Definitely great to hear that. I mean, that’s always important for everyone out there. So great to hear that from Inscribe. So that our listeners can get a good understanding of Inscribe, what would you say are some key problems that you solve for clients?

Brianna: The clients we typically work with are traditional financial services companies—banks, credit unions, lenders—as well as fintechs, credit card providers, crypto exchanges, property managers, and marketplaces. The problem we’re helping these companies solve is that with generative AI, bad actors are able to make incredibly realistic fraudulent documents. These fakes are almost impossible to detect, and 90% of document fraud is actually invisible to the human eye. At Inscribe, we develop solutions that are deeply technical using the most innovative large language models and continuous improvements to stay ahead in that cat-and-mouse game of fraud prevention. Our risk intelligence solution today enables customers to efficiently and effectively detect fraud attempts, but we’re already building for the next wave of generative AI-enabled fraud with our AI risk agents. Generative AI enables us to create AI risk agents that can read, write, and reason like humans. Rest assured, it’s much more than a chatbot. The agents we’re building are autonomous teammates that can automate tasks previously done by humans, specifically tasks across different systems. The power of these AI agents is that they can run thousands of fraud checks in parallel, 24 hours a day, helping our customers’ teams 10x their output.

Ernesto: That’s crazy. Like you mentioned, is there another vertical that you guys would go for, or is this pretty much the segment that you guys like going forward as your ICP?

Brianna: Yeah, we’re primarily focused on financial services and fintechs right now, but the sky is the limit. We get a lot of inbound from different industries—insurance, property management, tenant screening, as I mentioned. Document fraud is a very specific type of problem where you need to spend a long time training AI and machine learning models on specific types of documents. Different industries need fraud models that are experts in different types of documents. Our fraud models right now are deep experts in all types of financial proof of income, proof of address documents. But in the future, absolutely, there are a lot of other industries we’re interested in exploring.

Ernesto: Definitely. Awesome, great to hear that. So, how would these industries usually find out about Inscribe? Is there a top client acquisition channel for you guys?

Brianna: Yeah, I love this question. I could talk about this all day. Our audience typically finds us through one of our top five acquisition channels: trade shows, webinars, organic search, direct web traffic, and email. Email for us, in terms of acquisition, specifically third-party emails, but also database marketing and nurture emails, is a huge conversion lever. We diligently measure our top acquisition channels by using something I call a marketing efficiency ratio or a channel efficiency ratio. This takes our total pipeline generated dollar amount from our top five channels last year, divided by the total investment in each channel last year, to generate this efficiency ratio for each channel. It helps answer the question, “What are my most efficient and effective marketing channels?” This helps us determine what go-to-market investments to make and helps with forecasting. I can take the dollar amount we’re planning to invest in each channel, multiply it by its correlated efficiency metric, and get a fairly accurate estimate of the pipeline we’ll generate. Among those five channels, organic search and direct web traffic are huge for us.

Ernesto: Definitely. Awesome to hear that. For our listeners who are tuned in, they could always check you out at inscribe.ai. What role does the website play for client acquisition?

Brianna: Huge role, both in terms of organic search traffic and direct web traffic. They have our highest channel efficiency ratios, but organic web traffic can be largely dependent on market demand, and direct web traffic depends on market demand and brand awareness. These channels have a high return for us, but they also have a bit of a higher risk than something like a trade show, which reliably generates sales meetings and opportunities. One of our website’s strengths is that it shows up in a lot of the top spots on page one of Google. We’ve made and continue to make significant investments in SEO because you can capture people who are actively searching for a solution with high purchase intent. Another strength of our website is that both visually and verbally, it communicates not only how our solution works but also the value and ROI of adopting Inscribe. We have a lot of content resources—blog posts, news, and press articles—that help attract customers, investors, and employees. And honestly, I think our brand design is pretty badass. We had a genius brand designer we gave a lot of creative freedom to. There were times when I was uncertain about the direction, but we trusted him, and the result is incredible. The flip side is that because the design and development are so sophisticated, it’s tough to maintain. It might be a bit too sophisticated for our company’s size, but the positive reactions we’ve received make it a worthwhile trade-off.

Ernesto: That’s great to hear. Based on that, are there any tools, methods, or tips you’d recommend to our listeners for website lead generation?

Brianna: Interactive product tours are big right now. We have one on our website, and it’s been very successful for us. Most of the buyers’ journey happens before they ask to speak with a team member—they do their research, look at your content and case studies, and the last thing they want is to understand how the tool actually works. But many companies insist on multiple discovery and pitch calls before showing a demo. As a frequent buyer of technology, that frustrates me. I’m busy; I’ve done my research. There are tools available that make it easy to build a product tour without needing engineering or product involvement. We use Novatic, and it’s been effective. Our interactive product tour is frequently the last touch before someone converts to request a demo. It’s been a very successful investment for us.

Ernesto: Awesome to hear. Let’s switch gears a little, Bree, and talk about you as a leader. You are the head of marketing at Inscribe. What are some key tasks you focus on in your day-to-day work?

Brianna: Data and analytics. I believe all marketers and marketing leaders of the future need to become data scientists. Whether I’m looking at revenue metrics, funnel metrics, acquisition metrics, conversion metrics, market demand signals, or customer feedback, I’m always digging into data analysis. I’m looking for insight—why did something work or not work, and what will we do differently? I’m also ensuring our leading indicators are on track to hit our OKRs and revenue goals. My most important responsibility is generating the pipeline coverage needed to hit our revenue targets, and predictable revenue requires constant vigilance. It’s like being in a mission control center to ensure our hypothesized trajectory stays on course and making corrections when needed.

Ernesto: Definitely, some great stuff from you there. Now let’s jump into our next section, Bree, which is a rapid-fire question round. Are you ready?

Brianna: I hope so.

Ernesto: Perfect. First off, what is the last book you read?

Brianna: I went through an unexpected loss in my family last year, so I’m trying to understand grief. I just finished “The Year of Magical Thinking” by Joan Didion, an incredible author and icon in journalism. I’m currently reading “The Grieving Brain,” which is about the neuroscience of grief. It might seem unrelated to marketing, but I believe everything about brain science and psychology relates to marketing.

Ernesto: I’m sorry for your loss, but like you mentioned, understanding the brain and human emotions ties directly into marketing. Next up, what is one thing your company is focused on most at the moment?

Brianna: Generative AI. The capabilities unlocked by generative AI are out of this world, and we’ve only scratched the surface. With generative AI, we can teach large language models to take machine learning models, string them together with human logic, and explain that logic clearly. AI agents are going to power the future of work in a very meaningful way. Our number one focus as a company is understanding what this AI agent future will look like and how we can help our customers lead that future.

Ernesto: Agreed. If there were no boundaries in technology, what would you fix for your role as a marketer today?

Brianna: I would love a tool for collecting customer feedback at scale—demand signals, workflows customers want automated, and technology they’d pay for. There are tools that do this, but they’re still very manual. I want something like ChatGPT where I could just ask, “What would my customers say about this?” and get an answer. Also, I’d love an internal marketing enablement tool—something to keep the company updated on go-to-market wins, losses, and learnings without overwhelming people. And, please, someone build an AI assistant for Slack. Slack has hit the point where it’s become more of a productivity drain than a gain. I’d love an AI assistant to help manage Slack.

Ernesto: That would be great! Is there a repetitive task you would automate?

Brianna: Definitely Slack messages, but I’d also want an AI agent for marketing that could look across channels, develop efficiency ratios, forecast pipeline, and recommend adjustments when we’re not hitting targets—all the things I do now with spreadsheets.

Ernesto: Finally, what advice would you give yourself if you were restarting your journey as a marketer today?

Brianna: Data—stay curious and somewhat obsessed with what’s working and not working. Become best friends with your sales leader and stay as close to revenue as possible.

Ernesto: Great advice! Thank you so much, Bree, for joining us. To our listeners, thank you for tuning in. Check out Inscribe at inscribe.ai—AI-powered risk intelligence for fraud, credit, and compliance. Looking forward to our next episode at Pathmonk Presents. Thanks a lot, Bree.

Brianna: Thanks for having me.