Introduction

In this episode, we welcome Kedar Karkare, co-founder of Karma Wallet, a revolutionary financial company putting consumers at the center of the financial system.

Kedar explains how Karma Wallet enables individuals to support brands aligned with their personal values while earning incentives and rewards. He discusses the challenges faced by consumers, brands, and financial institutions in today’s digital commerce world and how Karma Wallet addresses these issues. Kedar shares insights on their recent acquisition of an e-commerce marketplace, client acquisition strategies, and his perspective on website lead generation.

This episode offers valuable insights for anyone interested in ethical finance, consumer-centric business models, and the future of digital banking.

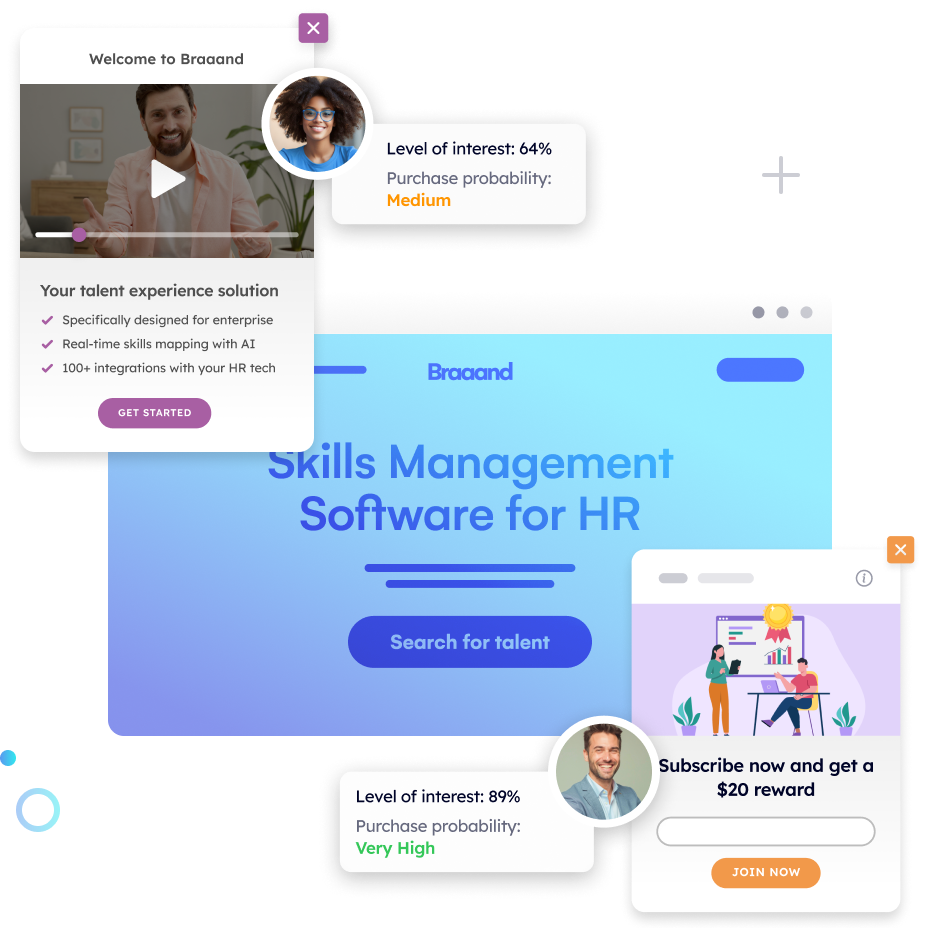

Increase +180% conversions from your website with AI

Get more conversions from your existing traffic by delivering personalized experiences in real time.

- Adapt your website to each visitor’s intent automatically

- Increase conversions without redesigns or dev work

- Turn anonymous traffic into revenue at scale

Ernesto Quezada: Pathmonk is the intelligent tool for website lead generation. With increasing online competition, over 98% of website visitors don’t convert. The ability to successfully show your value proposition and support visitors in their buying journey separates you from the competition online. Pathmonk qualifies and converts leads on your website by figuring out where they are in the buying journey and influencing them in key decision moments. With relevant micro-experiences like case studies, intro videos, and much more, stay relevant to your visitors and increase conversions by 50%. Add Pathmonk to your website in seconds. Let the AI do all the work and get access to 50% more qualified leads while you keep doing marketing and sales as usual. Check us on pathmonk.com. Welcome to today’s episode. Let’s talk about today’s guest. We have Kedar from Karma Wallet, co-founder there. How are you doing today?

Kedar Karkare: I’m good. How are you?

Ernesto: I’m doing great, thank you so much for being on with us today. Well, Kedar, I’m sure our listeners are tuning in, wondering what Karma Wallet is all about. So, in your own words, tell us a little bit more.

Kedar: Yeah, Karma Wallet is fundamentally a new kind of financial company that puts the consumer—the human—at the center of the financial system, as opposed to at the bottom. So what that means is we enable you, as an individual, to make sure that you’re supporting the brands and companies that align with your personal values. And then we give you incentives and rewards for doing that.

Ernesto: Definitely, great. So then, that way, our listeners can get a good understanding of Karma Wallet. What would you say is the key problem that you guys like to solve for clients?

Kedar: Yeah, that’s a great question. We have three different stakeholders, if you will. There’s the consumer or individual, brands, and financial institutions. At a macro level, if you think about the way our economy and financial system work—especially on the consumer side—those are the three parties involved in any transaction. For consumers, we solve the existential guilt and anxiety they might feel when making a purchase online or in person, as money just goes out there without them really knowing how it supports, or doesn’t support, things they care about. For brands, especially with Gen Z, building loyalty and trust is about honesty and transparency. Brands work with us to show their values transparently and ethically. On the financial institution side, it’s tough to acquire younger customers and keep them loyal. We help them attract and retain younger consumers who want to see their money make a difference, in addition to growing their wealth.

Ernesto: Interesting. So, would those be your main verticals, or is there another ICP for you guys?

Kedar: Exactly, yeah. Those are pretty much the three stakeholders in the ecosystem we’re building.

Ernesto: Perfect. And you guys just acquired one of your own, right? A digital marketplace?

Kedar: Yeah. We acquired an e-commerce marketplace with ethical, sustainable, and vetted brands. So, we wanted to offer our financial products in a space where you could easily make purchases that align with your values. As a Karma Wallet member, which costs $40 a year, you have access to the debit card, the app, and now, 10% off all purchases with free shipping in the marketplace.

Ernesto: That’s awesome to hear! So, how would someone usually find out about Karma Wallet? Is there a top client acquisition channel for you?

Kedar: Great question. For consumers, we use some paid ads, work with creators, and tap into social media communities in sustainability and personal finance. On the brand side, it’s more of an outbound strategy—our partnerships team reaches out to ethical brands. For financial institutions, it’s very relationship-driven.

Ernesto: Great, so that way, our listeners who are tuned in can check you out at karmawallet.io. What role does the website play in client acquisition?

Kedar: The website is about building trust. It’s not so much for direct conversions; it’s more for transparency, offering data that shows what we’re about, and building relationships that eventually convert.

Ernesto: Any tools, tips, or methods for website lead generation that you’d recommend to our listeners?

Kedar: Not so much tools specifically, but I’d say focusing on trust-building. Providing as much free, valuable content as possible can go a long way. Instead of gated content, offer valuable information upfront, and let that trust lead to organic relationships.

Ernesto: Great insight, thank you. Let’s switch gears a little bit, Kedar, and talk about you as a leader. What are some key tasks you like to focus on in your day-to-day?

Kedar: As a co-founder, it’s easy to get stretched thin. I try to stay focused on storytelling, whether it’s with our team, stakeholders, or consumers. I point the ship in the right direction and rely on our amazing team to handle the execution.

Ernesto: Great leadership approach! Is there a specific channel you use to stay up-to-date with trends in the marketing world?

Kedar: I’m on LinkedIn and follow a few newsletters, but increasingly, I rely on personal experiences and insights from my network to stay updated.

Ernesto: That’s a refreshing approach. Let’s jump into our rapid-fire question round. Are you ready?

Kedar: Let’s do it.

Ernesto: First, what’s the last book you read?

Kedar: “Be Like Water,” a Bruce Lee biography written by his daughter.

Ernesto: If there were no boundaries in technology, what would be one thing you’d want to fix in your role as a marketer?

Kedar: I’d love true “social listening” that captures actual conversations, not just online content—so we get real insights into people’s lives and concerns.

Ernesto: Interesting. Next, if you could automate one repetitive task, what would it be?

Kedar: Managing emails and relationship follow-ups, both personally and professionally.

Ernesto: Good one. Lastly, what’s one piece of advice you’d give yourself if you were to restart your journey as a marketer?

Kedar: Words matter. Each word evokes different emotions, so choose language carefully to resonate emotionally with people.

Ernesto: Great advice. And finally, if someone forgets everything about today’s interview, what’s the one thing they should remember about Karma Wallet?

Kedar: Every action you take, whether purchasing or not, creates karma. It’s about being aware of the impact your choices make in the world.

Ernesto: Fantastic message. Thank you, Kedar, for being on with us today. And to our listeners, you can check them out at karmawallet.io, your membership to a better future. Thanks a lot, Kedar.

Kedar: Thank you, Ernesto.