Lead generation is a critical aspect of marketing strategy across industries, but it holds particular significance in the financial services sector. This industry, encompassing banks, insurance companies, investment firms, and other financial institutions relies heavily on generating high-quality leads to sustain and grow their businesses.

The process of lead generation in financial services involves identifying and nurturing potential customers who may be interested in the products or services offered. Given the competitive landscape and the intricate nature of financial products, effective lead-generation strategies are essential for building trust, educating potential clients, and guiding them through the decision-making process.

Table of Contents

AI and Its Potential Impact on Lead Generation for Finance

AI technologies, through data analysis, pattern recognition, and predictive analytics, can significantly improve the efficiency and effectiveness of lead generation strategies. By leveraging AI, financial services can benefit from more personalized marketing approaches, improved customer segmentation, and the ability to identify potential leads with greater precision. AI tools can analyze vast amounts of data to predict which individuals or businesses are most likely to become customers, thereby allowing for more targeted and cost-effective marketing campaigns.

The Need for Improved Lead Generation in Financial Services

In the financial services industry, the importance of lead generation cannot be overstated. Effective lead generation not only helps in acquiring new customers but also plays a crucial role in retaining existing ones by identifying opportunities for cross-selling and upselling. With the ever-increasing competition and changing consumer behaviors, financial services companies must continuously innovate and improve their lead generation strategies to stay ahead.

The integration of AI into lead generation processes presents a promising opportunity to address these challenges. AI-driven tools and techniques can help financial services firms to better understand their target market, tailor their offerings to meet customer needs and engage with potential clients in more meaningful and effective ways. By automating routine tasks, AI can also free up valuable resources, allowing firms to focus on nurturing relationships with high-potential leads.

Challenges faced by financial service companies in traditional lead generation methods

Difficulty in Adapting to Digital Consumer Behaviors

- Shift to Online Research: Modern consumers lean heavily on internet research and peer reviews, diminishing the effectiveness of cold calls or print ads.

- Preference for Digital Engagement: There’s a growing expectation for brands to engage with consumers directly on digital platforms, something traditional methods don’t facilitate.

Inefficiency in Lead Processing and Nurturing

- Manual Tasks: Tasks like data entry and lead tracking are prone to errors and consume significant time and resources.

- Delayed Responses: The lack of automation can lead to slow responses, reducing the chance of converting leads into customers.

- Inconsistent Follow-Up: Manual processes often result in inconsistent follow-up communications, potentially losing interested leads.

Struggles with Lead Qualification and Prioritization

- Assessing Lead Readiness: Traditional methods lack the sophistication to accurately assess and score lead readiness and interest.

- Resource Misallocation: Without clear lead prioritization, sales teams may waste time on low-potential prospects.

- Generic Outreach: The absence of targeted information can lead to generic outreach efforts that fail to engage the most promising leads.

Limited Insight into Lead Generation Effectiveness

- Lack of Analytics: Traditional lead generation methods do not provide actionable insights or detailed analytics on campaign performance.

- Difficulty in Strategy Adjustment: Without clear performance data, it’s challenging to identify which aspects of the lead generation strategy need refinement.

High Costs and Low ROI of Traditional Methods

- Upfront Investment: Direct mail campaigns, telemarketing, and print ads require significant investment with uncertain returns.

- Low Conversion Rates: Traditional methods often result in lower conversion rates, driving up the cost per lead.

How to Solve Lead Geration Challenges with AI?

The integration of Artificial Intelligence into the lead generation process presents a transformative solution to the challenges financial service companies face with traditional methods. AI brings a host of capabilities that not only streamline the lead generation process but also enhance its effectiveness, providing a much-needed edge in the competitive financial services sector.

Enhanced Personalization and Targeting

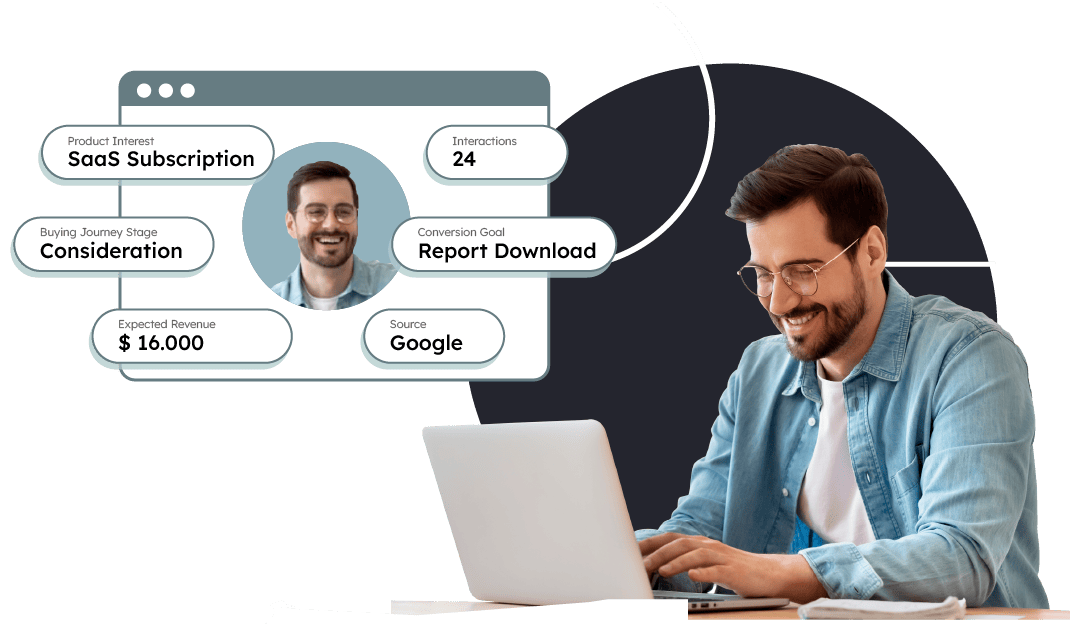

AI’s ability to analyze vast amounts of data through predictive analytics allows for unprecedented targeting precision. It identifies potential leads based on historical data and current behaviors, predicting which individuals are most likely to convert. This level of personalization ensures that marketing messages resonate deeply with the intended audience, significantly improving engagement rates. Moreover, AI’s dynamic content personalization tailors interactions to meet the specific interests and needs of each lead, further enhancing the chances of conversion.

Streamlining Lead Qualification and Prioritization

Through automated lead scoring, AI quickly assesses the potential of each lead, prioritizing those most likely to convert. This prioritization allows sales teams to focus their efforts more effectively, engaging with leads that show the highest propensity for conversion. Additionally, AI’s behavioral analysis provides deeper insights into a lead’s purchase readiness by examining their online behaviors and engagement patterns, ensuring that follow-up actions are timely and relevant.

Optimizing Lead Nurturing Processes

AI revolutionizes lead nurturing by automating follow-up communications and customizing nurturing paths for each lead. This automation ensures that leads are engaged at the optimal times, increasing the likelihood of moving them further down the sales funnel. The customization of nurturing paths, based on individual lead data, means that each lead receives content and offers that are most relevant to their specific situation, enhancing engagement and conversion rates.

Improving Efficiency and Reducing Costs

By automating repetitive and time-consuming tasks such as data entry and lead capture, AI significantly reduces manual labor and associated costs. This efficiency allows financial service companies to allocate their resources more effectively, focusing on activities that yield a higher return on investment.

Gaining Actionable Insights

AI provides comprehensive analytics capabilities, enabling financial service companies to measure the effectiveness of their lead-generation strategies in real time. These advanced analytics offer actionable insights, allowing for the continuous refinement and optimization of lead-generation efforts. Moreover, AI’s capacity for continuous learning ensures that strategies are adjusted and improved based on the latest data, keeping financial service companies ahead of the curve.

Lead Generation for Different Types of Finance Companies

The financial services industry encompasses a wide range of services and clientele, necessitating varied lead-generation strategies tailored to the unique needs and behaviors of each sector’s target market.

Retail Banks: Traditional vs. Digital Lead Generation Methods

Retail banks have long capitalized on the trust and familiarity built through physical branches and community presence. Traditional methods like in-branch promotions, local sponsorships, and face-to-face customer service have been staples in attracting new clients. These methods benefit from personal interaction, offering immediate trust-building opportunities and the ability to address complex customer needs on the spot.

In contrast, digital lead generation strategies for retail banks have taken center stage in recent years, driven by changing consumer behaviors and technological advancements. Digital platforms enable banks to reach a broader audience through SEO, social media, and targeted online advertising. Personalized email marketing campaigns and mobile banking apps not only serve existing customers but also act as effective tools for acquiring new leads by offering convenience and tailored banking solutions. Digital analytics tools provide insights into customer preferences and behaviors, allowing for more strategic targeting and segmentation.

Investment Firms: Content Marketing and Educational Resources for Attracting Leads

Investment firms are increasingly turning to content marketing as a means to demonstrate expertise, build brand authority, and engage potential clients. High-quality, informative content that addresses current market trends, investment strategies, and financial planning tips draws in individuals seeking to make informed investment decisions. This approach positions firms as thought leaders, fostering trust and credibility among potential leads.

Educational resources, such as webinars, e-books, and interactive tools, provide value to potential clients at various stages of their investment journey. By offering these resources for free, firms create a funnel of educated leads who are more likely to engage in their services. Tailoring content to specific segments of the market allows firms to address the unique interests and concerns of different investor types, improving the effectiveness of their lead-generation efforts.

Insurance Companies: Leveraging Partnerships and Direct Marketing for Lead Acquisition

Insurance companies traditionally rely on direct marketing and partnerships to generate leads. Collaborations with businesses in related sectors—such as automotive, real estate, and healthcare—open channels to a captive audience who are already in need of insurance products. These partnerships often include co-branded marketing efforts and exclusive offers for partner clients, seamlessly integrating insurance options into related purchasing processes. The increasing use of digital tools and platforms allows for more sophisticated targeting and personalization, enhancing the efficiency and effectiveness of these campaigns.

Fintech Startups: Technology-driven Approaches for Tech-savvy Consumers

Fintech startups, characterized by their innovative use of technology, adopt cutting-edge strategies to engage with a digitally native audience. These companies leverage big data and analytics to understand consumer behaviors and preferences, crafting highly targeted marketing campaigns. Social media marketing, influencer partnerships, and content marketing are key strategies, that appeal to younger demographics who value transparency, convenience, and personalization.

The use of mobile technology, including apps that offer financial management tools, instant loan approvals, and investment platforms, serves as both a service offering and a lead generation mechanism. Gamification elements, such as rewards for saving money or completing financial education modules, engage users while subtly encouraging them to explore additional services offered by the fintech.

Wealth Management Firms: Networking and Personalized Consultations Among High-net-worth Individuals

Wealth management firms focus on building deep, personal relationships with high-net-worth individuals, often relying on networking and referrals as primary lead-generation strategies. Exclusive events, seminars, and personal introductions create opportunities for firms to demonstrate their expertise and personalized service offerings. These interactions are crucial in building trust and establishing the firm’s value proposition to potential clients who expect a high level of personalization and expertise.

Personalized consultations offer a direct avenue for engaging potential clients, allowing advisors to showcase their knowledge and tailor their advice to the individual’s financial situation and goals. Utilizing AI-powered CRM systems, wealth management firms can maintain detailed records of interactions and preferences, enabling highly customized follow-up and nurturing strategies. This personalized approach not only helps in converting leads into clients but also fosters long-term relationships that are essential in the wealth management sector.

7 Essential Financial Services Lead Generation Strategies

- Content Marketing and SEO: Creating valuable, informative content tailored to the needs and questions of your target audience establishes your company as a thought leader and attracts organic traffic. Coupled with strong SEO practices, content marketing can significantly increase your visibility and attract high-quality leads.

- Social Media Engagement: Utilize platforms where your target audience is most active to share insights, company news, and engaging content. Social media advertising can also be highly targeted, allowing you to reach specific demographics, interests, and behaviors.

- Email Marketing Campaigns: Personalized email campaigns remain a powerful tool for nurturing leads through the sales funnel. Segmenting your email list allows for more targeted messaging, increasing the relevance and effectiveness of your communications.

- Webinars and Online Events: Hosting informative webinars and online events can attract potential leads interested in learning more about financial services. These platforms offer an opportunity to showcase your expertise and engage with attendees in real time.

- Referral Programs: Encouraging your satisfied clients to refer friends and family can be an effective way to generate new leads. Offering incentives for both the referrer and the new client can further enhance the success of your referral program.

- Utilizing AI and Machine Learning for Targeted Advertising: AI and machine learning algorithms can analyze user behavior and preferences to serve highly targeted advertisements across various digital platforms. This approach ensures that your marketing efforts reach those most likely to be interested in your services.

- Pathmonk Accelerate for Website Personalization: Incorporating Pathmonk Accelerate into your website can revolutionize your lead generation strategy. Our tool utilizes AI to analyze visitor behavior in real-time, allowing for dynamic website personalization. By adjusting content, calls-to-action, and offers based on individual user behavior, our tool significantly increases engagement and conversion rates. Its ability to automate lead generation processes, from capturing interest to guiding users towards conversion, makes it an invaluable tool for financial services looking to enhance their digital presence and efficiency.

Increase +180%

leads

demos

sales

bookings

from your website with AI

Get more conversions from your existing website traffic delivering personalized experiences.

Ethical Considerations in AI-driven Lead Generation

The deployment of AI in lead generation within the financial services industry brings to the forefront various ethical considerations. As companies navigate through the integration of these advanced technologies, it’s imperative to address concerns related to privacy, data security, and transparency. Building trust with clients becomes paramount, especially in an era where consumers are increasingly aware of their digital footprint and concerned about how their personal information is used.

Ethical Concerns

- Data Privacy: The collection and analysis of user data by AI systems raise significant privacy concerns. Financial services companies must ensure that the data used for lead generation is obtained ethically and with explicit consent from the users. There’s a thin line between personalization and intrusion, which companies need to navigate carefully.

- Bias and Fairness: AI algorithms are only as unbiased as the data they’re trained on. There’s a risk of perpetuating existing biases or creating new ones, which can lead to unfair targeting or exclusion of certain groups. Ensuring fairness and eliminating bias in AI algorithms is crucial for ethical lead generation practices.

- Transparency and Accountability: Companies must be transparent about their use of AI in lead generation processes. Consumers should be informed about how their data is being used and have the option to opt-out. Additionally, there should be accountability measures in place for the outcomes of AI-driven lead-generation strategies.

Building Trust

To mitigate these ethical concerns, financial companies must prioritize building trust through:

- Clear Communication: Being upfront and transparent with clients about the use of AI and how it impacts their interaction with the company is essential. Clear communication about data use policies and the benefits of AI-driven personalization can help alleviate privacy concerns.

- Adhering to Regulations: Compliance with privacy regulations such as GDPR in Europe, CCPA in California, and other local laws is non-negotiable. These regulations set the standard for data protection and privacy, and adherence to them is crucial in building trust.

- Implementing Ethical AI Practices: This includes regularly auditing AI algorithms for bias, ensuring data security, and adopting transparent data collection methods. Ethical AI practices not only build trust but also enhance the company’s reputation.

Conclusion

By adopting a blend of traditional and digital methods, personalized content, and cutting-edge technologies like Pathmonk Accelerate, financial services can achieve a more targeted and efficient approach to lead generation.

However, these advancements must be navigated with a keen awareness of ethical considerations, particularly regarding data privacy, bias, and transparency. Adopting ethical AI practices and prioritizing the building of trust will not only comply with regulatory standards but also solidify client relationships in the long term. As the industry moves forward, the integration of technology in lead generation processes must be balanced with ethical responsibility, ensuring that innovation does not come at the expense of consumer rights and trust.